What is it?

You can elect to delay receiving Social Security retirement benefits

You can choose to delay receiving Social Security retirement benefits until you are past normal (full) retirement age. Perhaps you want to work longer because you enjoy it, or maybe you want your retirement benefit to be higher when you finally do retire.

Your benefit will be increased by the delayed retirement credit

If you are eligible to receive Social Security retirement benefits but you delay receiving benefits until after normal retirement age, you will be eligible to receive the delayed retirement credit. The delayed retirement credit increases your retirement benefit by a predetermined percentage of your primary insurance amount (PIA) for each month you delay receiving retirement benefits up to the maximum age of 70. The amount of the credit you receive depends upon two factors:

- What year you were born

- How many months you delayed receiving retirement benefits past normal retirement age

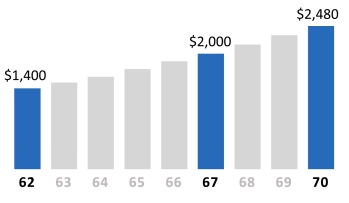

If you were born in 1943 or later, you will receive 2/3 of 1 percent more per month or 8 percent more per year if you delay receiving retirement benefits. So, for example, if your normal retirement age is 66, and you delay retirement until age 70, your benefit at age 70 will be 32 percent more than it would be at age 66. If your normal retirement age is 67, and you delay retirement until age 70, your benefit at age 70 will be 24 percent more than it would be at age 66.

Although the delayed retirement credit increases your Social Security retirement benefit, it does not increase your PIA.

When can it be used?

You must be eligible to receive delayed retirement benefits

In order to receive delayed retirement benefits, you must meet the following criteria:

- You must be at least one month older than normal retirement age, and

- You must be fully insured for retirement benefits (in most cases have 40 quarters of coverage).

You must apply for benefits

Receiving delayed retirement benefits is not automatic. You must apply for benefits when you want to begin receiving them. The Social Security Administration (SSA) recommends that you contact an SSA representative two or three months before you want to begin receiving benefits. You can call the SSA at 1-800-772-1213 for more information.

Strengths

Your retirement benefit will increase

If you continue to work past normal retirement age and delay receiving Social Security retirement benefits, you may increase your retirement benefit in two ways. Not only will you receive a delayed retirement credit, but your earnings after normal retirement age may be substantial enough to increase your average indexed monthly earnings (AIME), upon which your benefit is based.

Your surviving spouse’s benefit will increase

If you elect to receive delayed retirement benefits, then die, your surviving spouse (at normal retirement age) may receive 100 percent of the benefit you were receiving. Therefore, if your spouse has a life expectancy substantially greater than your own, you might consider delaying retirement so that your spouse may receive a higher benefit after you die.

Your delayed retirement credit isn’t counted toward your family maximum

When you retire, your family may be eligible to receive benefits based on your PIA. These benefits may be limited by the family maximum, which generally ranges from 150 to 180 percent of your PIA. However, if you delay receiving retirement benefits, your delayed retirement credit won’t count toward your family maximum and can be paid whether or not your family’s benefits are limited by the family maximum.

Tradeoffs

Delaying retirement won’t necessarily increase your lifetime retirement benefit

Just because you receive a higher monthly benefit when you delay retirement doesn’t necessarily mean you’ll receive a higher overall lifetime benefit. If you delay receiving retirement benefits, the amount of each benefit check will be higher, but you’ll receive fewer benefit checks than you would have if you begin receiving retirement benefits at normal retirement age. How many fewer checks you receive will depend upon how many years you delay receiving retirement benefits.

For example, assume the following facts apply to you:

- You delay retirement by 4 years, and retire at age 70 instead of at age 66, making you eligible for an 8 percent delayed retirement credit for each year you delay retirement. You will receive 48 fewer benefit checks.

- Your PIA is $1,000, so if you retire at age 66, your annual benefit will be $12,000. If you retire at age 70, your monthly benefit will be increased by $320, so your annual benefit will be $15,840.

- Assume that even if you’ve saved or invested all or part of your benefits, your real rate of return is 0 percent.

Using these factors, it would take you more than 12 years from the time you retire at age 70 to reach the point at which your benefits would crossover with the amount you would have accumulated if you began receiving benefits at age 66 (does not take into account annual cost of living increases):

|

By this Age |

Accumulated Benefit if Retirement Age is 66 |

Accumulated Benefit if Retirement Age is 70 (32% credit has been earned) |

|---|---|---|

|

70 |

$ 48,000 |

$0 |

|

76 |

$120,000 |

$95,040 |

|

82 |

$192,000 |

$190,080 |

|

83 |

$204,000 |

$205,920 |

If you were to die before reaching this crossover point, your lifetime benefits would be lower than if you had retired at your normal retirement age. Conversely, if you were to die after reaching this crossover point, then your lifetime benefits would be higher. That’s why life expectancy is one of the factors to consider when deciding whether to delay receiving Social Security retirement benefits.

The delayed retirement credit won’t increase benefits paid to most family members

When you earn the delayed retirement credit, your retirement benefit will increase. However, because the delayed retirement credit doesn’t affect your PIA, benefits that are paid to family members won’t increase (unless you die, at which time your surviving spouse may receive the same benefit you were receiving).

How to do it

Decide whether you want to delay receiving retirement benefits by comparing your options

You can estimate your retirement benefit online using the Retirement Estimator calculator on the Social Security website (ssa.gov). You can create different scenarios based on current law that will illustrate how different earnings amounts and retirement ages will affect the benefit you receive. Remember, this considers only your earnings and gives a basic calculation of the amount you earn from delaying. If you have anything more complex, like retirement as a couple or pulling from an ex-spouse’s benefit, you might want to work with an expert to ensure you have not missed any of the details that might affect your benefits; we can help with a flat fee Social Security plan that will give you peace of mind with the current 2800+ regulations that govern Social Security.

Consider the following questions before making your decision

- Why do you want to delay receiving retirement benefits?

- Can you afford to delay receiving retirement benefits, or do you need Social Security retirement income as soon as possible?

- Do you expect to live long enough to benefit from delaying your retirement benefits?

- How important is it to increase the amount of survivor income available to your spouse?

Apply for delayed Social Security retirement benefits

Three months before you’re ready to retire, fill out an application for benefits with the SSA.

Don’t forget to apply for Medicare benefits at age 65. See Questions & Answers.

Tax considerations

If you continue to work past normal retirement age, you will continue to pay Social Security or self-employment tax on your covered earnings. Even though your earnings may increase your AIME (and thus your retirement benefit), you may not be able to recoup those payroll taxes.

Questions & Answers

If you delay receiving Social Security retirement benefits, can you still receive Medicare at age 65?

Yes. Anyone age 65 or older who is entitled to receive Social Security benefits is eligible to receive Medicare, even if he or she has not yet filed an application for Social Security benefits. However, enrollment in Medicare is automatic only for individuals who are receiving Social Security retirement benefits for at least four months before reaching age 65. If you elect to delay receiving retirement benefits, you will need to apply for Medicare benefits online, in person, or through the mail.

Can you delay receiving Social Security retirement benefits until you’re 71 or older?

Yes, but there’s no advantage to waiting longer than age 70 to begin receiving Social Security retirement benefits. You can earn the delayed retirement credit only up until age 70. In addition, if you want to work, any money you earn from working after age 70 won’t decrease your Social Security retirement benefit. So why wait?

If you are interested in our Social Security planning options, learn more here! We understand retirement planning can be daunting, and we are here to make it easier for you. Our newsletter is a great way to stay up-to-date with our latest offerings and get helpful retirement planning tips. Signing up is easy; click here. We appreciate your interest in our services and look forward to helping you retire better!

Broadridge Investor Communication Solutions, Inc. prepared this material for use by Social Security Benefit Planners, LLC.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances. Social Security Benefit Planners, LLC provide these materials for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Social Security Benefit Planners, LLC and its affiliates are in no way associated with or approved, endorsed, or authorized by the Social Security Administration.

working and the amount you’ve earned. When you begin taking Social Security benefits also greatly affects the size of your benefit.

working and the amount you’ve earned. When you begin taking Social Security benefits also greatly affects the size of your benefit.