What is increasing your average indexed monthly earnings (AIME)?

Your Social Security retirement benefit is based on your lifetime earnings. In general, if you were born after 1928, your benefit is calculated by averaging your 35 years of highest earnings to determine your AIME, then applying a benefit formula to that amount. To get the maximum payable monthly retirement benefit, your earnings in each of those 35 years has to equal the maximum earnings base (also called the contribution and benefit base) for that year. The maximum earnings base for 2021 is $142,800.

How does it work?

If you have earned less than the maximum base in any one of your earnings years, you can increase your AIME by working as long as you need to in order to replace that year of lower earnings with a year of higher earnings in the AIME calculation. This strategy is particularly effective if you can replace years of very low or zero earnings with years of higher earnings.

Rip worked continuously for 25 years before he was old enough to retire. However, when his retirement benefit was calculated, he had only 25 years of earnings, so 10 years of zero earnings had to be included in his AIME calculation. This lowered his AIME substantially and thus lowered his retirement benefit. So Rip decided to work 5 years longer so that his years of zero earnings would be replaced in the AIME calculation by his 5 years of higher earnings.

When is your AIME calculated?

When you become entitled to retirement benefits

At age 62, your AIME is calculated using your earnings up to and including age 61. Then a benefit formula is applied to your AIME to determine your primary insurance amount (PIA), upon which your retirement benefit will be based. Even if you choose to receive retirement benefits later, your PIA is established at age 62, although it will be recalculated later to account for money you earned after age 61.

When you have new earnings

The Social Security Administration (SSA) will automatically recalculate your AIME and PIA for any year you have new earnings–or earnings that were not included in the original AIME calculation–that are substantial enough to replace one of the 35 years in the benefit calculation. Because your AIME is calculated using your highest earnings years, this recalculation will always result in a benefit increase. This benefit increase is effective on January 1 following the year the earnings were paid.

Suzanne’s AIME was calculated in the year she turned 62 using her lifetime earnings up to and including age 61. However, Suzanne earned $40,000 during the year she turned 62, enough to replace a year of lower earnings in her AIME calculation. So the SSA automatically recalculated her AIME to include those earnings. When she began receiving retirement benefits three years later, her benefit reflected her new, higher AIME.

What earnings are used to calculate your AIME?

Earnings credited to your Social Security record

The earnings used to calculate your AIME are the earnings credited to your Social Security earnings record. This includes earnings both before and after retirement. If you’re employed in an occupation covered by Social Security, your employer reports your earnings annually to the SSA. If you’re self-employed, the IRS reports your earnings annually to the SSA. However, only wages or self-employment income up to the maximum earnings base for that year may be credited.

Earnings that are indexed and earnings that are not indexed

Most of the earnings used to calculate your AIME are indexed earnings, but some nonindexed earnings are also included. When calculating your AIME, the SSA first indexes (adjusts to reflect current wage amounts) any earnings you received after 1951 but before the year you turn 60. Next, the SSA picks out your highest 35 years of earnings to calculate your AIME. However, the SSA doesn’t just consider your indexed earnings in the calculation; it also considers your actual earnings (earnings you had at or after age 60, which are not indexed).

What earnings are not used to calculate your AIME?

Earnings that have not been credited to your Social Security record

The Wage and Tax Statement (W-2) that you receive from your employer reflects the amount of Social Security tax you have paid, as well as the amount of wages that should have been credited to your Social Security record that year. (Note: Your earnings reported to the SSA can’t exceed the maximum earnings limit for that year.) If you think your earnings have been incorrectly reported, contact the SSA to resolve the discrepancy.

Earnings not subject to Social Security taxes or the self-employment tax: There are many types of earnings that are not subject to Social Security taxes or the self-employment tax. Some of the most common types are listed as follows:

- Social Security benefits

- Payments under workers’ compensation law

- Payments made to or from a qualified pension or annuity plan

- Cash tips under $20 per month

- Earnings under Civil Service Retirement System

- Unemployment compensation

Because these types of income won’t count as earnings for Social Security purposes, don’t rely on them to help you increase your AIME.

When can this strategy be used?

You may be able to use this strategy when:

- One or more years of little or no earnings will be included in your AIME calculation

- You have earned less than the maximum during any of your 35 years of highest earnings

You will not be able to use this strategy if:

You have had maximum earnings in each of the 35 years included in the AIME calculation. In this case, you would not benefit from earning more because no earnings year can be replaced in the calculation by a year of higher earnings.

Strengths

You may increase your retirement benefit, as well as benefits for your family members

Anytime you increase your PIA (which is based on your AIME), your retirement benefit will increase. Because family members may also receive benefits based on your PIA, their benefits will increase as well when your PIA increases (as long as the family maximum doesn’t apply).

Tradeoffs

The difference between the new earnings and the old earnings may not be great enough to justify working longer

Before deciding to work additional years to increase your AIME, you should consider how much greater your new earnings will be than your old earnings. Say, for example, that your earnings during one of the 35 years used in the calculation are not much less than the maximum earnings allowed. In this case, the increase in the benefit you receive if you replace that year in the AIME calculation may not be substantial enough to justify working longer. However, if you have a year of no earnings included in your AIME calculation, you may profit more from substituting a year of high or maximum earnings for that year.

The additional payroll taxes you incur may limit the effectiveness of working longer

Your earnings during the additional years you work to try to increase your AIME will be subject to Social Security or self-employment payroll taxes. These taxes may lessen or eliminate the benefit you receive from working longer to increase your AIME.

Because Jasmine had a year of low earnings included in her AIME calculation, she decided that she could increase her AIME by working an extra year. So instead of retiring at age 62, she decided to postpone her retirement until age 63 and was able to substitute that year’s earnings of $40,000 for the year of low earnings in her AIME calculation. This increased her retirement benefit by $1 per month, or $12 per year. However, because she was self-employed, she had to pay 7.65 percent in payroll taxes on that year’s earnings, or $306. Therefore, it took Jasmine more than 25 years ($306 divided by 12) to make up the increased taxes she paid working an additional year to increase her AIME.

Increasing your AIME may only marginally affect your benefit if your AIME already falls in the top tier of the benefit formula

Once your AIME is calculated, a benefit formula is applied to it to determine your primary insurance amount (PIA). Because this benefit formula is weighted to favor low-income individuals, increasing your AIME may not be an effective strategy for you if your AIME is already in the top range of the benefit formula, because only 15 percent of your AIME will be affected.

Julio’s AIME was calculated to be $3,000 in 1998. The SSA figured Julio’s benefit (using 1998 bend points) by adding together three percentages of his AIME:

|

90% of the first $477 |

$ 429.30 |

|

32% of the AIME from $478 to $2,875 |

$ 764.04 |

|

15% of the AIME greater than $2,875 |

$ 18.75 |

|

|

$1,212.09 |

Since Julio’s AIME was already in the top range of the benefit formula, he wouldn’t have benefitted much from extra earnings. If, for example, Julio had managed to increase his AIME to $3,200, here’s what would have happened:

|

90% of the first $477 |

$ 429.30 |

|

32% of the AIME from $478 to $2,875 |

$ 764.04 |

|

15% of the AIME greater than $2,875 |

$ 48.75 |

|

|

$1,242.09 |

Even though Julio increased his AIME by $200 by working additional years, he only increased his monthly benefit by $30 (2.47 percent).

However, if Julio’s AIME was in the middle portion of the formula, he would have benefitted more from increasing his AIME. For example, if Julio’s AIME was calculated to be $2,600, here’s what would have happened:

|

90% of the first $477 |

$ 429.30 |

|

32% of the AIME from $478 to $2,875 |

$ 679.36 |

|

|

$1,108.66 |

However, if he increased his AIME to $2,800, here’s what would have happened:

|

90% of the first $477 |

$ 429.30 |

|

32% of the AIME from $478 to $2,875 |

$ 743.36 |

|

|

$1,172.66 |

In this case, when Julio increased his AIME by $200 by working additional years, he increased his monthly benefit by $64 (5.77 percent).

Note: Bend points for 2021 are $996 and $6,002.

Questions & Answers

Will earnings after retirement affect your AIME?

Yes. Any covered earnings you receive after you begin getting retirement benefits can be included in your AIME calculation. However, if you retire early and continue to earn income, you can only earn up to a certain amount (called the earned income limit) before you begin to lose benefits due to excess earnings. Conversely, if you don’t elect to receive early retirement benefits, the amount you earn by working won’t ever affect your benefit negatively. In addition, your earnings at the end of your career tend to be your highest ones, and they can then be substituted for lower ones in your AIME.

Discover how we can enhance your retirement with our range of Social Security planning solutions. Plus, stay connected through our informative newsletter. Join now by clicking here!

Broadridge Investor Communication Solutions, Inc. prepared this material for use by Social Security Benefit Planners, LLC.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances. Social Security Benefit Planners, LLC provide these materials for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Social Security Benefit Planners, LLC and its affiliates are in no way associated with or approved, endorsed, or authorized by the Social Security Administration.

What is it?

What is it?

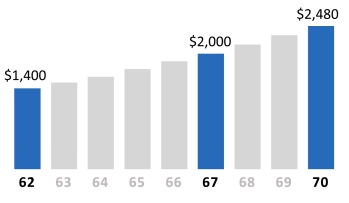

working and the amount you’ve earned. When you begin taking Social Security benefits also greatly affects the size of your benefit.

working and the amount you’ve earned. When you begin taking Social Security benefits also greatly affects the size of your benefit.