What is it?

What is it?

Before you receive any Social Security benefits, the Social Security Administration (SSA) will need to determine your eligibility. Remember that Social Security is an insurance system designed to pay you benefits during times of economic hardship. Just as a medical insurance plan representative must review your policy coverage before paying your surgical bill, a Social Security administrator must examine your Social Security record to ensure that you are eligible for the type of benefit for which you have applied. Determining your eligibility will mean finding answers to the following questions:

- Have your earnings been subject to Social Security taxes?

- What is your insured status?

- Have you met the eligibility requirements specific to your benefit claim?

- Have you filed your benefit claim?

Your earnings have probably been subject to Social Security taxes

Most people are covered by Social Security. Since Social Security is compulsory, most company employees, members of the armed forces, and self-employed persons participate and will someday be eligible for benefits. Two groups that are excluded from Social Security coverage are railroad workers whose work is covered by the Railroad Retirement Act and federal employees hired before 1984, who are covered under the Civil Service Retirement System (CSRS). Special coverage terms apply to other groups, including hospital interns, farm workers, members of religious orders, student nurses, newspaper vendors, and domestic workers. If you are covered by Social Security, you will know it when you look at your paycheck. Currently, 6.2 percent of your pay up to an annual limit of $160,200 (in 2023) is deducted each pay period. A 1.45 percent Medicare tax is also withheld from your pay (no annual limit applies). Your employer matches your tax payments. If you are self-employed, you pay a 15.3 percent self-employment tax on your net earnings to finance Social Security.

Your insured status affects your eligibility for benefits

Your insured status is the foundation of any benefit claim. You are considered insured when you have acquired a certain number of Social Security credits. These credits are also known as quarters of coverage. Covered workers receive credits based on their annual earnings. Every year, the earnings necessary to earn one credit increase according to how much the national average wage has increased. In 2023, you earn one credit for every $1,640 in earned income, up to a maximum of four credits per year.

Earning Social Security credits (quarters of coverage)

Credits earned are based on your total annual income

The number of credits you earn in a year depends upon how much money you made, not how many months you worked. For instance, if you work for two months in 2023 and make $3,280, you will have earned two credits ($1,640 x 2). If you work six months and make $3,280, you will also have earned two credits. To earn three credits, you would have to earn at least $4,920 ($1,640 x 3). To earn four credits for the year, you would have to make at least $6,560, the income required to earn the maximum number.

Credits are awarded in whole units only

If you earn $3,280 in 2023, you will earn two credits. If you earn $4,100, you will still earn only two credits, not two and one-half credits, since credits are awarded in whole units only.

Credits can be acquired at any age (even after retirement age)

You’re never too old to earn credits. Unless you’ve already reached the maximum credits possible (40 credits), any income you have that is subject to Social Security taxes can earn you more credits, even if you are already old enough to retire.

Credits can’t be lost once you’ve earned them

Once you earn the credits, they’re yours to keep, even if you never work again.

Credits don’t determine the amount of your Social Security benefit

The size of your benefit check has nothing to do with how many credits you have earned. They only determine what type of benefits for which you might be eligible.

Fully insured status versus currently insured status

Determining your insured status is important because if you have not acquired the credits necessary to receive Social Security benefits, your claim will be denied even if you meet other eligibility requirements. Generally, you need to be fully insured to receive Social Security benefits, but other requirements may also apply. Once you are fully insured you are also permanently insured and you will not lose your fully-insured status if you stop working under covered employment.

Obtaining fully insured status means that you are entitled to full Social Security benefits. To become fully insured you must:

- Earn 40 credits (10 years in work subject to Social Security taxes) or

- Earn at least one credit for each calendar year elapsing after the year in which you reached age 21 and before the year in which you reach age 62, die, or become disabled (whichever comes first), and earn at least six total credits

Example(s): Example A: John died after suffering a head injury. He was 45. He had earned 30 credits during his lifetime. Because he had earned at least one credit for every year that had elapsed between the year he turned 21 and the year he died, he was fully insured, and his survivors were entitled to benefits based on his Social Security earnings record.

Note: A special rule applies to survivors benefits. Even if you didn’t earn the number of credits needed before your death, your children and your spouse who is caring for the children can get benefits if you have credits for one and one-half year’s work (6 credits) in the three years just before your death.

Disability-insured status

If you have earned at least 20 credits during the last ten years and you are fully insured you have disability-insured status. Exceptions apply for those under age 31 and in certain other cases.

- Before age 24: If you become disabled in or before the quarter you turn age 24, you generally must have earned six credits during the three-year period ending with the quarter your disability began

- Age 24 to 31: You may qualify if you have credit for working half the time between age 21 and the time you became disabled

- Age 31 or older: If you are disabled at age 31 or older, you generally need at least 20 credits in the last 10 years immediately before you became disabled. You can view a table that shows examples of how many credits you would need if you became disabled at various ages at the SSA website, ssa.gov.

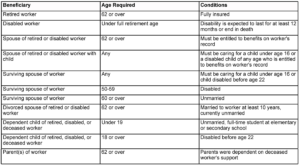

Basic eligibility requirements for beneficiaries

In general, you can receive Social Security benefits if you meet the eligibility requirements for your type of claim. The following table outlines the basic requirements for beneficiaries but does not include all eligibility requirements.

When you file your claim for benefits, you may be asked to submit proof of age, family relationship, school attendance, and, in some cases, citizenship. These documents will be used to support your application for benefits and determine if you are eligible for them.

How you can file for benefits

Social Security benefits are not automatic. To receive benefits, you must apply for them online or by making an appointment at your local Social Security office or by calling the SSA (see below). You should file promptly in person, by mail, or by phone.

- For retirement benefits: The SSA recommends that you apply for benefits three months before you want your benefits to start.

- For survivor benefits: File for benefits in the month of the insured worker’s death. Each entitled person should file.

- For disability benefits: You can file for benefits before you actually become entitled to benefits. If you file early (for example, before the five-month waiting period has ended), and your claim is approved, your application date is considered to be the first month you have satisfied the eligibility requirements.

- For the lump-sum death payment: The beneficiary should file within two years of the insured person’s death.

If you have any questions about filing a benefit claim, or want information regarding eligibility for benefits, call the SSA at (800) 772-1213 or visit its website at ssa.gov.

Thank you for taking the time to read this article. We hope it has given you some insight into Social Security. If you have any questions or would like more information, please feel free to contact us. We would love to hear from you. Our newsletter is a great way to stay up-to-date with our latest offerings and get helpful retirement planning tips. Signing up is easy; click here.

Broadridge Investor Communication Solutions, Inc. prepared this material for use by Social Security Benefit Planners, LLC.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances. Social Security Benefit Planners, LLC provide these materials for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Social Security Benefit Planners, LLC and its affiliates are in no way associated with or approved, endorsed, or authorized by the Social Security Administration.

needed retirement income. Social Security provides other important benefits too, including disability and survivor benefits that can help you and your family members.

needed retirement income. Social Security provides other important benefits too, including disability and survivor benefits that can help you and your family members.

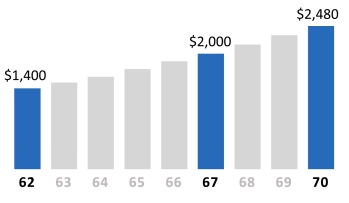

working and the amount you’ve earned. When you begin taking Social Security benefits also greatly affects the size of your benefit.

working and the amount you’ve earned. When you begin taking Social Security benefits also greatly affects the size of your benefit.