What is it?

When planning your estate, consider how much your survivors might receive from Social Security. Social Security survivor’s benefits can provide much-needed income to your family and ensure that their financial life after your death is easier.

Who will be eligible to receive survivor’s benefits after your death?

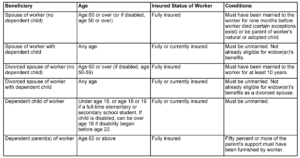

Knowing your insured status is essential to determining who will be eligible to receive Social Security survivor’s benefits based on your earnings record. If you were fully insured, meaning that you have 40 Social Security credits (quarters of coverage) at the time of your death, more of your survivors may be eligible for benefits than if you were currently insured (having 6 credits during the last 13 quarters prior to your death).

If you are fully insured

If you are fully insured, survivor’s benefits can protect those family members who are most dependent on you for financial support. If you are fully insured at the time of your death, benefits may be paid to the following family members:

- Your spouse

- Your divorced spouse

- Your dependent child or children

- Your dependent parents

If you are currently insured

If you are currently insured at the time of your death, benefits may be paid to these family members only:

- Your spouse (only if caring for a dependent child)

- Your divorced spouse (only if caring for a dependent child)

- Your dependent child or children

The following table illustrates who may be eligible to receive survivor’s benefits and under what conditions:

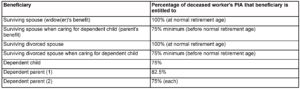

What benefits will your survivors receive after you die?

Your eligible surviving family member will receive a monthly benefit based on your primary insurance amount (PIA) unless the survivor is eligible for a greater benefit based on his or her own PIA. Survivor’s benefits are expressed as a percentage of your PIA:

Survivor’s benefits may be reduced for one or more of the following reasons:

Beneficiary is younger than normal retirement age when he or she elects to receive benefits

This factor affects the surviving spouse or the surviving divorced spouse of the worker. If the surviving spouse is at least normal retirement age, the benefit payable is 100 percent of the deceased worker’s PIA. However, if the surviving spouse elects to receive benefits early (as early as age 60 or age 50 if disabled), the benefit payable will be reduced by 0.475 percent for each month between the month benefits begin and the month in which the spouse will reach normal retirement age. So, a surviving spouse with a normal retirement age of 66 who is age 61 will receive 71.5 percent of the deceased spouse’s PIA instead of 100 percent (60 months x 0.475 = 28.5 percent reduction). If the surviving spouse is disabled, the benefit will never drop below 71.5 percent of the deceased spouse’s PIA, even if the disabled spouse elects benefits at age 50.

Example(s): After Peter died at age 60, his wife, Patty, applied for survivor’s benefits. She was 62. Because she elected to receive benefits 48 months before her normal retirement age, she was entitled to receive 77.2 percent of her deceased husband’s PIA (48 months x 0.475 = 22.8 percent reduction).

Benefit is subject to the family maximum

Survivor’s benefits may also be reduced if they exceed the family maximum benefit. This commonly happens when benefits to children are payable along with a benefit to a surviving spouse. Because the family maximum benefit generally ranges from 150 to 180 percent of the worker’s PIA, a spouse’s benefit combined with the benefits for two children could easily exceed the family maximum. In this case, the benefit for each family member will be reduced accordingly.

The survivor’s earnings are more than the annual exempt amount

Benefits may be reduced when a surviving spouse’s earned income exceeds the annual earnings exempt amount.

Benefits to eligible family members end when:

- A surviving spouse entitled to parent’s benefits remarries (unless the new spouse is another benefit-eligible individual).

- A surviving spouse entitled to parent’s benefits loses eligibility because the child attains age 16 or loses disability status.

- A surviving divorced spouse remarries prior to age 60 (or age 50 if disabled). If the subsequent marriage ends, however, the spouse will again be eligible for benefits based on the deceased ex-spouse’s earnings.

- A dependent child turns 18 and is no longer enrolled in school. (If the child is enrolled full-time in secondary school, benefits may be payable to age 19.)

- A dependent child marries (unless the child is over 18 and disabled and marries another benefit-eligible individual).

- A dependent parent marries (unless parent marries another benefit-eligible individual).

- The beneficiary dies.

Who is eligible to receive the Social Security lump-sum death benefit?

Upon your death, your surviving spouse living in the same household with you at the time of your death will receive a $255 lump-sum death benefit. If there is no surviving spouse, the death benefit will be split among your children who are eligible for benefits based on your PIA. In the event you have no surviving spouse or children, the benefit will not be paid.

Planning tips for Social Security survivor’s benefits

When you have dependent children

If you have dependent children, check your Social Security record to make sure you are at least currently insured. If you die currently insured, your family might receive some income from survivor’s benefits. If you are not currently insured, consider working to obtain the required credits.

When you have no dependent children but are married

If you have no dependent children and are nearing retirement, check your Social Security record to make sure you are fully insured. If you die fully insured, your spouse may receive some income from survivor’s benefits when he or she turns age 60 (or age 50, if disabled).

When you have any family members who may be eligible for benefits on your Social Security record

Make sure your family members know your Social Security number and what benefits they may be entitled to when you die. To apply for benefits, your spouse may also need proof of marriage or divorce and copies of children’s birth certificates.

We love to help you retire better. Check out our many Social Security planning options. Also, we love to keep in touch with our newsletter; click here to sign up.

Broadridge Investor Communication Solutions, Inc. prepared this material for use by Social Security Benefit Planners, LLC.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on individual circumstances. Social Security Benefit Planners, LLC provide these materials for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Social Security Benefit Planners, LLC and its affiliates are in no way associated with or approved, endorsed, or authorized by the Social Security Administration.