- Even though your dreams were to always travel the world you didn’t save enough and love to watch “Rick Steve’s Europe” and “An Idiot Abroad” instead. It still feels like you are there, right?

- Living in a 600-square foot rental apartment in retirement with no spectacular view was in the future plans.

- Or even better was your life long goal to move into the in-law suite on your kid’s property- now this could be extra fun!

- Being able to order anything off the dollar menu at any fast food restaurant always rocks – YUM.

- Not having the option to NOT work well after you wanted to retire. Hi Ho, Hi Ho off to work we go.

- Your 1982 Dodge Colt isn’t pretty but still gets you from A to B.. just not C.

- Delaying, reducing the dosage or not purchasing all your needed prescriptions because of the high cost. Who needs their health anyway!

Of course we want people to travel, have decent housing and food, the option to retire when they want and being able to take care of their health.

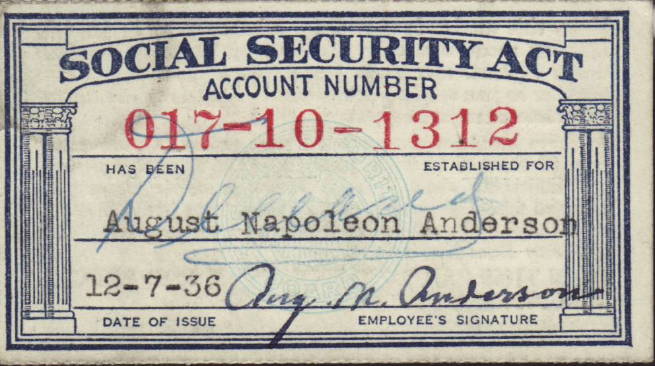

Did you know that almost 50% of Americans opt to take Social Security as early as they can and therefore lock themselves in up to a 30% permanent reduction in Social Security retirement income? We have helped many individuals and families see how they can increase their annual income anywhere from 3k to 30k per year.

Now that is some real Clams, Cheddar or Dough back in your pocket.

You paid into this over your whole career why not make the most of this valuable insurance program!

To get our free e-book go to www.socialsecuritybp.com or sign up to get your own customized plan to get your extra Clams today!

Not associated with or endorsed by the Social Security Administration or any other government agency.